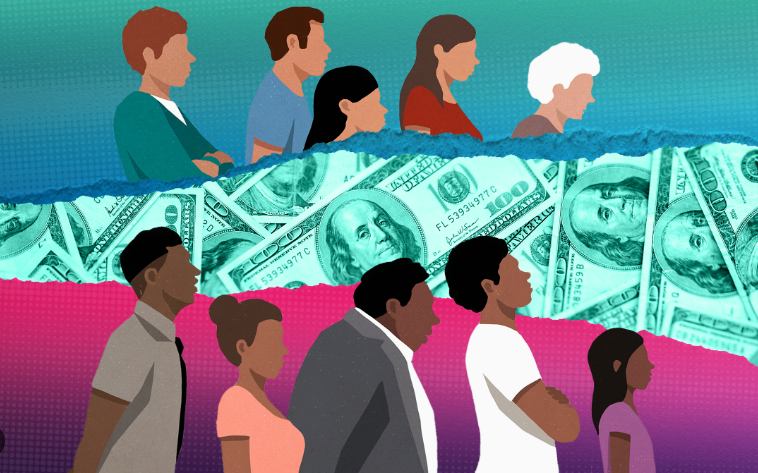

Eliminating the Black-White Wealth Gap: A Generational Challenge

It is time to talk about closing the racial wealth gap. The importance of household wealth has become abundantly clear during the COVID-19 pandemic. Wealth is the difference between what families own—for instance, their savings and checking accounts, retirement savings, houses, and cars—and what they owe on credit cards, student loans, and mortgages, among other debts.

Yet wealth is vastly unequally distributed across the United States. Black households have a fraction of the wealth of white households, leaving them in a much more precarious financial situation when a crisis strikes and with fewer economic opportunities. Wealth allows households to weather a financial emergency such as a layoff or a family member’s illness.

The Racial Wealth Gap

The racial wealth gap is the difference between the average wealth of white households and the average wealth of black households. The gap is both persistent and growing: in 2016, the median white household had ten times the wealth of the median black household. This gap is primarily due to the history of systemic racism in the United States, including discriminatory housing policies, job discrimination, and the exclusion of African Americans from the Social Security system.

The gap is also perpetuated by the fact that black households are more likely to live in poverty and the higher cost of living that comes with living in an underserved community. Further, black households are more likely to be headed by a single parent, making it even more difficult to accumulate wealth.

The Effects of the Gap

The wealth gap has wide-reaching effects on the economic security of African Americans. Without access to wealth, black households are more likely to struggle to cover basic expenses such as food, housing, and medical care. This lack of financial security can lead to higher rates of stress, anxiety, and depression.

The wealth gap also limits the economic opportunity for African Americans. Without access to wealth, black households are less likely to be able to invest in businesses or education, meaning they are less likely to be able to increase their earning potential. This lack of opportunity can lead to a vicious cycle of poverty and inequality.

What Can Be Done?

Closing the racial wealth gap requires a comprehensive approach. Local governments can invest in economic development initiatives in underserved communities, which can create jobs, increase access to financial services, and provide access to wealth-building opportunities. At the federal level, policies such as increasing the minimum wage, expanding the Earned Income Tax Credit, and increasing access to affordable housing can help to close the wealth gap. Finally, employers can work to reduce racial discrimination in the workplace and ensure that employees are paid equitably. The greatest gains will be achieved by Blacks understanding the wealth-building process and shifting how we view and handle money.

A Generational Challenge

The wealth gap between black and white households is a generational challenge and one that will not be solved overnight. It will take a concerted effort from all levels of government and employers to ensure that all Americans, regardless of race, have access to the same economic opportunities. Closing the racial wealth gap is essential for creating an equitable and just society and will benefit all Americans long-term.

Preliminary Summation

The wealth gap between black and white households is a systemic problem that has been decades in the making. We must take action to close this gap, ensuring economic security for African Americans and creating a more equitable and just society for all. Closing the racial wealth gap requires a comprehensive approach that includes investments in economic development initiatives, policies to increase wages and access to affordable housing, and efforts to reduce discrimination in the workplace. This is a generational challenge and one that will take time, effort, and dedication to solve.

10 Keys to Building Generational Wealth to Close the Racial Wealth Gap

Building generational wealth can be daunting, especially for professionals who are already busy managing their careers and day-to-day lives. However, building a secure financial future for yourself and your family is possible with the right knowledge and strategy. Here are 10 essential keys to building generational wealth for professionals.

1. Have a Clear Vision

The first step to building generational wealth is to have a clear vision. It is essential to define your goals and objectives so that you know what you are working towards. Ask yourself questions such as: What do I want to achieve in the next 5 years? What do I want the financial future of my family to look like? Once you have a clear vision, you can start planning your strategy.

It is also important to continually review and adjust your vision as your life, and financial situation change. This will ensure that you are always on track to reach your goals.

2. Develop a Financial Plan

The next key to building generational wealth is to develop a financial plan. A financial plan will help you to understand your current financial situation, set goals, and create a plan to reach those goals. When creating your financial plan, it is essential to consider factors such as income, expenses, investments, debts, and savings. By having a clear plan of action, you can maximize your financial potential and achieve your goals.

Reviewing your financial plan regularly and making adjustments where necessary is also critical. This will help ensure that your plan remains relevant and up to date.

3. Invest for the Future

Investing is one of the most powerful tools for building generational wealth. Investing in stocks, bonds, real estate, or other assets can provide a steady income stream and help grow your wealth over time. Before investing, it is crucial to understand the risks and rewards associated with each investment. You should also consider factors such as your risk tolerance and financial goals.

It is also vital to diversify your investments. This will help reduce risk and ensure you are not overexposed to any asset class.

4. Be Frugal and Live Within Your Means

Living within your means is essential for building generational wealth. It is important to focus on saving money and using it wisely. This means avoiding unnecessary purchases and living frugally. It is also important to pay off any debts as soon as possible. Doing so will help to ensure that you are not paying high-interest rates and that your money is working for you rather than against you.

It is also essential to have an emergency fund in place. An emergency fund will help prepare you for unexpected expenses or financial setbacks.

5. Utilize Tax Benefits

Taxes can eat away at your generational wealth, so taking advantage of any available tax benefits is vital. Consider investing in a retirement account, such as a 401(k) or IRA, which can provide tax savings and help you grow your wealth over time. You should also consider taking advantage of other tax benefits, such as deductions or credits.

It is also essential to stay current on any changes to the tax code, as these can significantly impact your financial situation.

6. Utilize Financial Education

Financial education is essential for building generational wealth. It is important to understand the basics of personal finance and stay current on any changes in the financial market. Many resources, such as books, online courses, and financial advisors, are available to help you learn more about money management and investing.

It is also essential to seek advice from trusted sources. Financial advisors can provide valuable advice and help you make informed decisions about your money.

Enroll In the Legacy Wealth AcademyGenerational Wealth Course

Register now and take advantage of the pre-launch rate before the enrollment cost converts to the regular price of $2,595.

7. Generate Multiple Sources of Income

Generating multiple income sources can help diversify your income and provide a steady stream of cash flow. Consider ways to generate passive income or to invest in assets that will appreciate in value over time. Considering alternative investments, such as real estate or commodities, is also important.

It is also essential to consider the tax implications of any investment, as this can significantly impact your financial situation.

8. Practice Patience and Discipline

Building generational wealth takes time and discipline. It is crucial to have a long-term outlook and to understand that there will be ups and downs along the way. Don’t get discouraged if you encounter setbacks or hiccups. Maintaining a positive attitude and patience will help you reach your goals.

It is also important to stay disciplined. This means sticking to your plan and not deviating from it. Staying disciplined will help ensure that you stay on track to reach your goals.

9. Take Calculated Risks

Taking calculated risks can help to increase your wealth and help you reach your goals. However, it is vital to understand the risks associated with any investment and to weigh the potential rewards against the potential losses. Diversifying your investments is crucial to not overexposing yourself to any asset class.

Using stop-loss orders to limit your losses and protect your capital is also vital. Doing so will help ensure you are not taking on too much risk.

10. Start Early and Stay Committed

The earlier you start building generational wealth, the better. Even small investments now can have a significant impact on your financial future. It is also important to stay committed to your plan and focus on your long-term goals.

By following these 10 keys to building generational wealth for professionals, you can ensure that you and your family have a secure financial future.

Conclusion

Building generational wealth is an important goal, but it can sometimes seem overwhelming. However, it is possible to achieve your financial goals with the right knowledge, strategy, and commitment. By following the 10 keys outlined here, professionals can take the necessary steps to ensure a secure financial future for themselves and their families. The key is to get started.