Black Group Economics in a Debt Based Economy

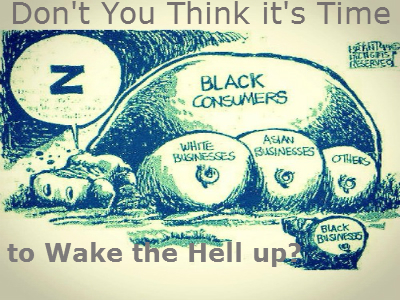

Over the past months, many of you have heard myself and others speak incessantly about the importance of blacks practicing vertical group economics. The truth behind this concept is actually very simple; however, the process through which it must be accomplished requires a little more thought. It is important for blacks to have, at least, a minimal perspicacity of what a debt-based economy is.

Over the past months, many of you have heard myself and others speak incessantly about the importance of blacks practicing vertical group economics. The truth behind this concept is actually very simple; however, the process through which it must be accomplished requires a little more thought. It is important for blacks to have, at least, a minimal perspicacity of what a debt-based economy is.

The Difference between Money and Currency

Building an economic infrastructure will call for more than simply owning and supporting black businesses. Revenue has to be generated in order to finance business growth and the opening of new businesses. This revenue will most likely be generated through some form of investment strategy — preferably one that is highly diversified and stable. For blacks to be effective in investing their existing capital, there are some simple things they must understand. One of the first things that they will need to understand is that there is a distinct difference between “money” and “currency”

Learn Explosive Strategies that Will Help You Build Profitable Email Lists!

Financial literacy is extremely important to, not only the wealth building process, but it carries a significant amount of gravity in creating the ability to sustain wealth. Wealth is not a protected asset; unless you take the necessary steps to protect it. It is amazing that the majority of people in the world are not aware of the difference between money and currency.

“Throughout the history of civilization, an epic battle has always been waged. It is an unseen battle, unknown by most of the people it affects. Yet, all feel the effects of this battle in their daily lives. This battle is between currency and money, and it is truly a battle of the ages.” (Mike Maloney, Guide for Investing in Gold and Silver)

If I had to simplify the difference between money and currency, I would say that currency is the piece of paper you have in your wallet and the coins you have your pocket. Currency is actually used in the form of an IOU. The value of the currency is actually underwritten by money. It is money that gives the currency value.

The Story of the Goldsmith

There is an old story of a goldsmith that is often used in finance and economics classes to explain the difference between money and currency. The goldsmith made jewelry, coins and gold bars, which were used as mediums of exchange — meaning people could trade them for goods and services.

Get Explosive Online Profits Using Private Label Rights!

One day a friend of the goldsmith asked him to allow him to store his personal gold in his shop vault. The goldsmith complied. In return for the gold, the goldsmith gave his friend a slip of paper that simply stated I.O.U. (I owe you), with the amount that the stored gold was worth written on it. Immediately, this little slip of paper carried the value of the gold. Over time, the people in the town would store their gold in the goldsmiths vault and he would issue them I.O.U.s. The slips of paper were much easier to handle and trade than gold, therefore the first currency system was born. There was a problem. The goldsmith noticed that the people in the town would rarely withdraw their gold. It was too easy for them to simply trade their IOUs. So the goldsmith began to print IOUs for gold that did not exist. This meant that the value of the currency actually depreciated, because the gold (money) was not there to underwrite its value. Once all the gold was gone, the people were left with worthless paper.

For a long time, the value of the U.S. dollar was underwritten by gold (money). Although a significant amount of the nation’s gold is kept and guarded at Fort Knox, KY, the majority of it is actually stored in underground vaults at the Federal Reserve Bank of New York.

What most people are unaware of is the fact the value of the U.S. dollar (currency) is no longer underwritten by gold and silver (money). Don’t toss away your precious metals just yet. Even though Gold and Silver doesn’t underwrite the value of U.S. currency any longer has not changed the fact that it is still money, and it will always be. That is why there are nations and individuals stockpiling gold as this article is being written.

The currency here in the U.S. and in most industrialized nations is now underwritten by debt, thus the term debt-based economy.

Understanding a Debt-based Economy

Many top economic and financial analysts hold that the world’s current monetary system was converted to a debt-based system when President Nixon suspended the existing link between gold and currency in 1971. This principle is based on the basic concept that debt is money, much in the same way as gold. To bring lucidity to this statement, revisit the story of the goldsmith. It was the gold that gave the IOUs their value. The value of all the world’s currency, except for those national economies in which gold and silver still underwrite the value of their currency, is underwritten by debt.

This came to be because once the connection between gold and currency was officially broken, there had to be a value base, which is money. After Nixon’s action in 1971, debt grew at a rapid pace, all while there was an increase in the creation of currency. This is why you have nations who have spent billions to buy up American debt.

If you have ever purchased or refinanced a home, you have probably noticed that within the first 60 to 90 days, you will receive a new payment book from a different lender for you to make your payments to. What you are experiencing is the results of what is known as buying and selling paper. The term “paper” is expressive of debt. The original lender may have been Chase Bank, but the investment bank that buys the paper will probably be a company whose name you don’t recognize. Basically, when you bought or refinanced the home, you signed an IOU to the mortgage company for the total amount financed, plus interest. The face value of the loan includes the interest, but the home only represents its true value, meaning that if you default early in the contract, the bank will lose money (short version). By selling the paper, which is considered a risk to the original lender, as long as they hold it, the original lender guarantees their profit. The new lien holder owns the debt, which they can sell or consistently collect payments on.

Investors buy all types of debt from credit card defaults to unpaid medical expenses. When a homeowner fails to pay their property taxes, and a lien is placed on their home, the investor that comes to buy that lien, has just purchased the homeowner’s debt. Therefore, you can see that there is a benefit in owning the debt of others, but having debt makes you vulnerable, if you have not discovered how to leverage it.

One way that blacks can grow our economy rapidly is through the purchase of debt from other groups, while minimizing our collective debt in the process. ~ Dr. Rick Wallace, Ph.D.